Money is an important part of life and understanding finances can be intimidating. Knowing what finance means and how they affect our daily lives can help us make better decisions when it comes to financial planning.

This article will explore the basic meaning of finance and discuss its importance in our lives. We will look at various financial topics, including investments, budgeting, and credit, and understand how each affects our future financial well-being.

What is Finance?

Finance is the management of money, investments, and other financial instruments. It encompasses all aspects of managing a person or organization’s monetary resources. In addition to being an important and necessary part of modern life, finance also has a deep history, with the earliest forms of banking dating back to ancient times.

At its core, finance involves taking control over how money is spent in order to achieve certain goals. Financial decisions are made by individuals as well as large organizations such as governments and businesses.

The field also includes areas such as accounting, economics, capital markets and investments. Through these disciplines and others, finance professionals analyze past data in order to evaluate current financial trends and inform future decisions about how best to manage resources for achieving success.

Personal Finance

Personal finance is an important topic that many individuals overlook. It encompasses a variety of areas related to managing one’s money such as budgeting, investing, retirement planning, and insurance. Understanding the fundamentals of personal finance can help individuals make smarter decisions with their money in order to reach their financial goals.

The first step in understanding personal finance is learning how to create and stick to a budget. This involves tracking income, and expenses, and setting limits on spending which helps ensure that expenses never exceed income.

Knowing one’s long-term financial goals will also help identify what investments are best suited for each individual situation. Businesses may need stocks or bonds while families may benefit from buying real estate or opening savings accounts for college funds or retirement plans.

Business Finance

Business finance is a crucial part of running a successful business. Understanding the basics of financial management, including cash flow and budgeting, is essential for any business owner. Business finance includes the processes and systems used to track financial activities within a company, such as investments, income, expenses and managing debt. Without proper financial tracking and analysis, businesses will have difficulty understanding their current situation or planning for future growth.

Investing Basics

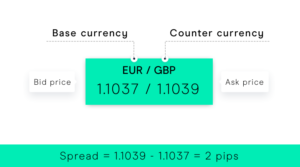

Investing is essential for building wealth, but it’s not always easy to understand. To make the best decisions, having an understanding of fundamental financial concepts is necessary.

Financial terms like assets and liabilities, stocks and bonds can be complex and hard to grasp. But with a basic knowledge of these concepts, you’ll have the foundation to make sound investments that will help grow your wealth over time.

When it comes to investing basics, one of the most important things to understand are assets and liabilities. Assets are items that have value and can be sold or exchanged for money – such as real estate or stocks.

Liabilities are debts owed by individuals or companies – such as mortgages or credit card debt. Knowing how to balance your assets against liabilities will help you determine where your money should be invested for maximum return on investment (ROI).

Conclusion

The conclusion of the article “What Do Finance Mean” has summarized that understanding finance is more than just numbers and equations. When understood, finance can be an effective tool to help individuals make sound decisions regarding their money.

In order to better understand what finance means, it would be beneficial to gain knowledge in areas such as economics, accounting, and financial markets. It is also important to keep up-to-date with financial news and trends. Additionally, having a general understanding of mathematics can aid in deciphering the various formulas and calculations used in financial analysis.

Lastly, practice makes perfect; develop a habit of budgeting one’s own finances or reviewing published financial statements of companies so that these concepts become second nature over time.

Be First to Comment