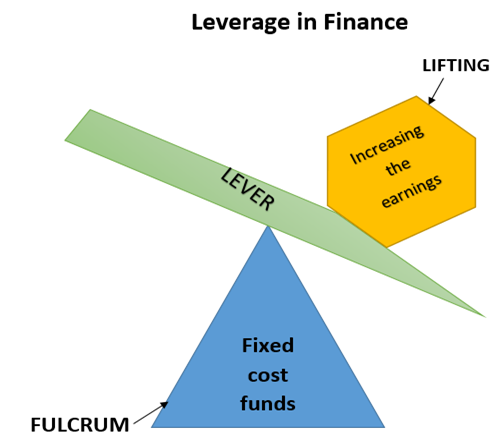

Finance leverage is a tool used by businesses and investors to increase the potential return on investment. It involves taking on additional debt or using other financial instruments to purchase assets. Leverage can be both beneficial and risky, depending on how it is used and the level of risk a business or investor is willing to take. By understanding how financial leverage works and its potential implications, businesses can make informed decisions when considering leveraging their investments.

Definition of Finance Leverage

Finance Leverage is an important concept for any business that wants to maximize its potential. In the simplest terms, financial leverage is the ability to use borrowed money in order to increase a company’s returns and profits. Utilizing this strategy, businesses can gain access to financial resources beyond what they currently own or control in order to expand their operations and increase their overall value.

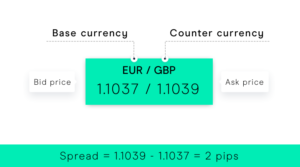

Finance leverage involves two different types of capital: debt and equity. Debt financing involves borrowing money from lenders such as banks or other financial institutions in exchange for interest payments, while equity financing involves raising funds from investors by selling part of the ownership of the company.

By utilizing one or more of these sources of funding, businesses are able to invest more money into activities such as research and development, marketing campaigns, acquisitions and other growth initiatives without having to commit all of their own capital upfront.

Types of Finance Leverage

Finance leverage is a process of using borrowed money to increase the potential return of an investment. Leverage can be used in both personal and business finance, and there are several types of financial leverage that have different advantages and disadvantages. To understand how to use finance leverage most effectively, it’s important to know the different kinds available.

One type of financial leverage is debt financing, which involves borrowing money from a lender such as a bank and then paying back the loan with interest over time. Debt financing can provide short-term capital for businesses or individuals when other sources are not available, but this type of financial instrument carries some risks since defaulting on loan payments could result in serious repayment penalties or even bankruptcy.

Another form of financial leverage is equity financing, which involves issuing shares in exchange for capital from investors.

Benefits of Using Leverage

Leverage can be an effective tool when it comes to financing, but many people don’t know exactly what it is. Finance leverage enables investors to use a relatively small amount of their own money to control larger investments, thereby magnifying the potential return on investment (ROI). This article will explain what finance leverage is and discuss its benefits.

Using leverage allows investors to access more capital than they have available in their own accounts. By borrowing money from a lender, they can purchase an asset that may not otherwise be affordable with just their own funds. Moreover, leveraging also reduces the risk associated with investing since profits are spread across two different sources: the investor’s own capital and borrowed money.

Risks of Using Leverage

Leverage can be an effective tool for businesses to increase profitability and gain a competitive edge, but it also comes with certain risks that must be taken into account. Leverage is the use of borrowed money to purchase assets or make investments. A company’s ability to leverage its resources allows it to acquire larger amounts of capital than would otherwise be available. However, this increased borrowing power carries with it significant risks that must not be overlooked.

The biggest risk associated with leveraging is that a business’s potential losses are amplified through the use of borrowed funds. If an investment does not perform as expected, the resulting losses may exceed those incurred from an investment made without leverage. Additionally, when using borrowed funds a company will have to pay interest on their debt which can further reduce potential returns from investments and put a strain on overall cash flow.

Conclusion

The conclusion of financial leverage is an important one to understand. This practice involves borrowing money to increase the potential return on investments, as well as reduce the overall risk of investing. When done correctly, leveraging can be a powerful tool for investors. However, if used incorrectly or without a proper understanding of its risks and rewards, it can put investors in a difficult financial situation.

It is important to remember that leveraging can be beneficial when done properly. To use it effectively, individuals need to have a solid understanding of their investment goals and how using debt can help them achieve those goals.

Furthermore, they should also take into consideration their financial positions and how much risk they are willing to take on before entering into any leveraged investments. By taking these steps and exercising caution overall, individuals may find that financial leverage is an effective way for them to grow their wealth over time.

Be First to Comment