Investing in foreign currencies can be a great way to diversify an investment portfolio, but it’s important to understand the basics before getting started. One of the most important concepts to understand is what are forex spreads and how they work. Forex spreads are the difference between a currency’s bid and ask prices, and understanding them is key when trading currencies. This article will provide an overview of forex spreads, explain why they exist, and discuss how traders use them in their trades.

Definition of a Spread

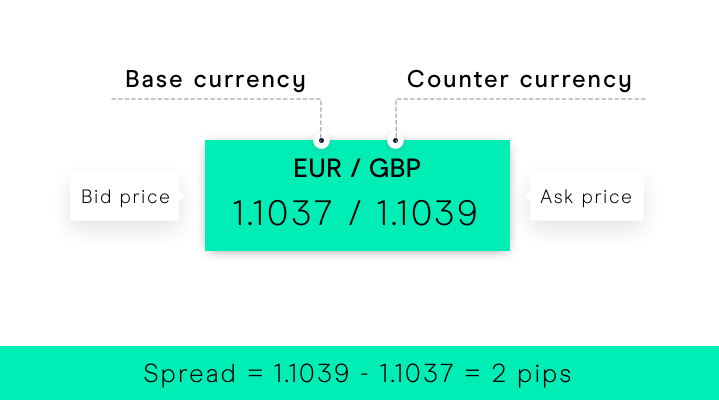

A spread is an important concept to understand and recognize when it comes to Forex trading. In simple terms, the spread is the difference between the bid and ask prices of a currency pair. It is essentially a commission that needs to be paid for each trade that takes place in the Forex market.

A trader makes money by anticipating changes in cost between two currencies before entering into a trade. Understanding how spreads work can help traders make more informed decisions when it comes to their trading activity in order to maximize their profits and minimize their losses.

How to Calculate Spreads

Forex spreads are the difference between the bid and ask prices of a currency pair in the forex market. Understanding how to calculate spreads is an important part of becoming a successful forex trader. Knowing what factors affect them can help you make better-informed trading decisions and increase your chances of success. This article will explain how to calculate forex spreads, as well as discuss some key points to keep in mind when trading them.

The basic formula for calculating a spread is simple: subtract the asking price from the bid price. This will give you the number of pips, or units that make up one-tenth of a cent (0.0001) for each currency pair, that separates both prices.

Impact of the Market on Spreads

Forex spreads are an important consideration for every trader, as they can impact both the potential profit and loss of a trade. Understanding spreads is essential for making informed decisions in the market, yet many traders lack knowledge about this critical element of trading.

The spread is essentially the difference between the buying price and the selling price of a currency pair in forex trading. The wider the spread, the more expensive it will be to enter into a trade. This means that traders need to take into account changes in spreads when entering and exiting positions in order to optimize their profits or minimize their losses.

The size of a spread depends on several factors including liquidity, volatility and even geopolitical events which can affect supply and demand for specific currencies.

Benefits of Low Spreads

Forex spreads are one of the most essential components when it comes to trading the foreign exchange market. Low spreads offer a range of benefits – from saving traders money to providing greater liquidity. If you’re curious about what forex spreads are, and why lower ones can benefit your trading, keep reading.

A low spread is simply the difference between the bid and ask prices on a specific currency pair or financial instrument in forex trading. The bid price is the cost at which you can purchase a currency pair, while the asking price is what you will pay for it when selling it. When these two numbers are closer together – that’s when we have a low spread. This essentially means that traders get more bang for their buck since they don’t need to pay as much in order to open and close positions in comparison to higher spreads.

Conclusion

The forex market has been around for hundreds of years and continues to remain relevant today. For investors looking to make the most of their potential profits, understanding Forex spreads is essential. Forex spreads are the difference between the bid and ask price of a currency pair. When trading in this market, it’s important to understand how these spreads affect your profit potential.

It’s important to remember that as a trader, you don’t get paid based on the spread but rather on the changes in currency values. The size of the spread will affect how much money you can make when trading since it affects your entry and exit prices. As such, it’s vital that you research different brokers carefully and determine which one provides the best quality with the lowest possible fees, including spreads.

Be First to Comment