Financial literacy plays an integral role in the success of self-employment, as it empowers individuals to make informed decisions about their finances. However, research has shown that certain demographic factors such as gender and race may affect an individual’s level of financial literacy and subsequently impact their ability to succeed in self-employment.

In this article, we will explore the relationship between financial literacy and self-employment among different genders and races. We will examine how these factors influence access to financial resources, decision-making skills, and overall understanding of financial concepts. The Lunafi contractor tax calculator is an excellent tool for anyone who works as an independent contractor or freelancer. Ultimately, our goal is to shed light on potential disparities and provide insights for promoting equal opportunities for all individuals seeking to pursue careers in self-employment.

Importance of financial literacy and self-employment

Financial literacy is essential for anyone considering self-employment. Being financially literate means having the knowledge and skills to make informed decisions about money management, budgeting, investing, taxes, and other financial matters. It is especially important for entrepreneurs who need to manage their finances effectively to ensure the success of their business.

However, studies have shown that gender and race can significantly impact an individual’s level of financial literacy. Women and minorities tend to have lower levels of financial literacy compared to men or non-minority groups. This disparity can create significant barriers for women and minorities who want to start a business or become self-employed.

Financial Literacy:

Financial literacy is an essential aspect of self-employment, regardless of gender and race. Self-employment requires individuals to be financially literate to manage their income, expenses, taxes, and investments effectively. Financial knowledge also helps entrepreneurs make informed decisions about their business operations and growth strategies.

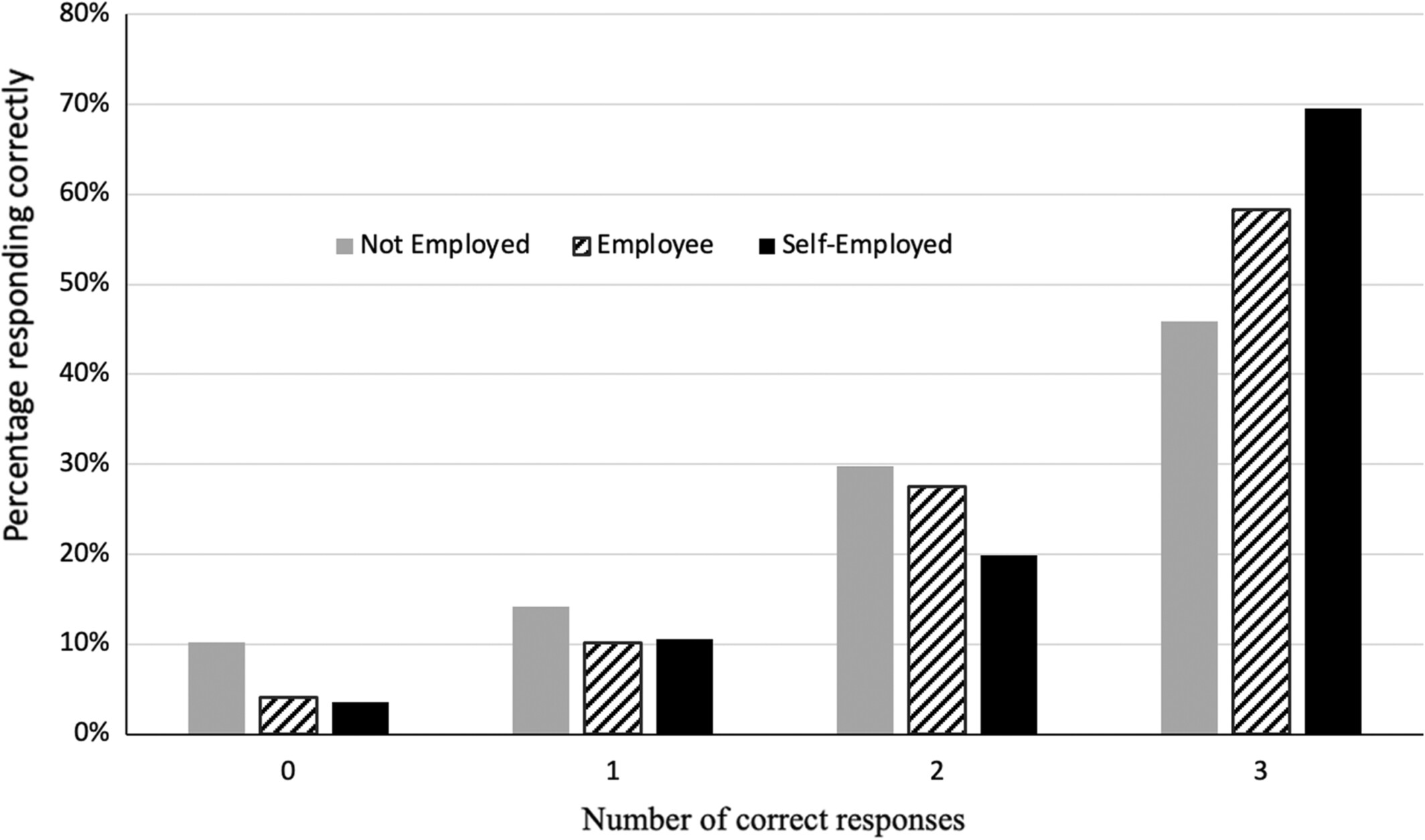

However, research shows that there are significant disparities in financial literacy levels based on gender and race. According to a study by the National Bureau of Economic Research (NBER), women score lower than men on financial literacy tests, which translates into lower retirement savings and investment portfolios for women. Similarly, African Americans and Hispanics tend to have lower levels of financial literacy than white Americans.

Self-Employment:

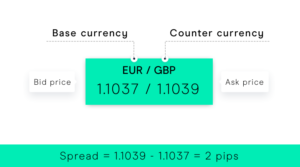

Self-employment can be a viable option for individuals who are interested in starting their own business or pursuing a career as an entrepreneur. However, it requires a certain level of financial literacy to manage finances effectively and ensure success. Financial literacy includes understanding basic financial concepts such as budgeting, cash flow management, and investment strategies. A contractor tax calculator can be helpful in estimating your taxes, it’s important to remember that it is not a substitute for professional advice from an accountant or tax specialist. Additionally, self-employed individuals must also have the ability to navigate tax laws and regulations.

Research has shown that there are significant differences in the rates of self-employment among different demographic groups. For example, men are more likely than women to be self-employed, and white individuals are more likely than people of color to pursue self-employment opportunities. These disparities can be attributed to various factors including access to capital and resources, social networks, and institutional barriers.

Advantages and Disadvantages

Advantages of financial literacy and self-employment are numerous. Firstly, having financial literacy skills can help individuals to make informed decisions about their finances, such as creating a budget, investing in stocks or saving for retirement. Secondly, self-employment allows individuals to have more control over their work-life balance and income potential. They can choose their own hours and rates while working on projects that align with their interests and values. Additionally, self-employed individuals have the potential to earn more money than those who are employed by others. However, there are also several disadvantages associated with financial literacy and self-employment. One disadvantage is that not everyone has access to financial education resources or the ability to become financially literate due to a lack of time or resources.

Gender and Race:

Gender and race play an important role in the financial literacy and self-employment of individuals. According to a study conducted by the National Bureau of Economic Research, women are less financially literate than men, which can have significant negative impacts on their ability to start and run successful businesses. Additionally, minority entrepreneurs often face barriers accessing capital and resources necessary for starting a business.

Furthermore, gender and racial disparities also exist in terms of income and wealth accumulation. Women earn less than men for the same work, which can limit their ability to save money or invest in their business ventures. Similarly, minority communities often have lower average incomes and limited access to financial institutions that can provide loans or other forms of funding.

How they impact financial literacy and self-employment

Gender and race have a significant impact on financial literacy and self-employment. Women, for instance, are less likely to be financially literate than men. Studies show that only 18% of women could answer basic financial questions correctly, compared to 35% of men. This gender gap in financial literacy could be due to several factors, including lack of access to resources such as financial education courses and unequal pay.

Similarly, race also plays a role in determining an individual’s level of financial literacy and self-employment success. Research has shown that African Americans and Hispanics are more likely to have low levels of financial literacy than whites. Moreover, they are less likely to own businesses or work for themselves compared to their white counterparts

Conclusion:

In conclusion, financial literacy is crucial for self-employment success regardless of gender and race. However, research suggests that women and minorities face more significant barriers related to access to resources and social norms. It is essential to recognize these obstacles and work towards creating more equitable opportunities for everyone. Providing financial education tailored to the unique needs of diverse communities can help bridge the gap in financial knowledge and lead to greater entrepreneurial success. We must continue to advocate for policies that promote financial inclusion, support small businesses, and empower underserved communities. Only then can we create a level playing field where everyone has an equal chance of achieving their dreams through self-employment.

Financial literacy plays an integral role in the success of self-employment, as it empowers individuals to make informed decisions about their finances. However, research has shown that certain demographic factors such as gender and race may affect an individual’s level of financial literacy and subsequently impact their ability to succeed in self-employment.

In this article, we will explore the relationship between financial literacy and self-employment among different genders and races. We will examine how these factors influence access to financial resources, decision-making skills, and overall understanding of financial concepts. The Lunafi contractor tax calculator is an excellent tool for anyone who works as an independent contractor or freelancer. Ultimately, our goal is to shed light on potential disparities and provide insights for promoting equal opportunities for all individuals seeking to pursue careers in self-employment.

Importance of financial literacy and self-employment

Financial literacy is essential for anyone considering self-employment. Being financially literate means having the knowledge and skills to make informed decisions about money management, budgeting, investing, taxes, and other financial matters. It is especially important for entrepreneurs who need to manage their finances effectively to ensure the success of their business.

However, studies have shown that gender and race can significantly impact an individual’s level of financial literacy. Women and minorities tend to have lower levels of financial literacy compared to men or non-minority groups. This disparity can create significant barriers for women and minorities who want to start a business or become self-employed.

Financial Literacy:

Financial literacy is an essential aspect of self-employment, regardless of gender and race. Self-employment requires individuals to be financially literate to manage their income, expenses, taxes, and investments effectively. Financial knowledge also helps entrepreneurs make informed decisions about their business operations and growth strategies.

However, research shows that there are significant disparities in financial literacy levels based on gender and race. According to a study by the National Bureau of Economic Research (NBER), women score lower than men on financial literacy tests, which translates into lower retirement savings and investment portfolios for women. Similarly, African Americans and Hispanics tend to have lower levels of financial literacy than white Americans.

Self-Employment:

Self-employment can be a viable option for individuals who are interested in starting their own business or pursuing a career as an entrepreneur. However, it requires a certain level of financial literacy to manage finances effectively and ensure success. Financial literacy includes understanding basic financial concepts such as budgeting, cash flow management, and investment strategies. A contractor tax calculator can be helpful in estimating your taxes, it’s important to remember that it is not a substitute for professional advice from an accountant or tax specialist. Additionally, self-employed individuals must also have the ability to navigate tax laws and regulations.

Research has shown that there are significant differences in the rates of self-employment among different demographic groups. For example, men are more likely than women to be self-employed, and white individuals are more likely than people of color to pursue self-employment opportunities. These disparities can be attributed to various factors including access to capital and resources, social networks, and institutional barriers.

Advantages and Disadvantages

Advantages of financial literacy and self-employment are numerous. Firstly, having financial literacy skills can help individuals to make informed decisions about their finances, such as creating a budget, investing in stocks or saving for retirement. Secondly, self-employment allows individuals to have more control over their work-life balance and income potential. They can choose their own hours and rates while working on projects that align with their interests and values. Additionally, self-employed individuals have the potential to earn more money than those who are employed by others. However, there are also several disadvantages associated with financial literacy and self-employment. One disadvantage is that not everyone has access to financial education resources or the ability to become financially literate due to a lack of time or resources.

Gender and Race:

Gender and race play an important role in the financial literacy and self-employment of individuals. According to a study conducted by the National Bureau of Economic Research, women are less financially literate than men, which can have significant negative impacts on their ability to start and run successful businesses. Additionally, minority entrepreneurs often face barriers accessing capital and resources necessary for starting a business.

Furthermore, gender and racial disparities also exist in terms of income and wealth accumulation. Women earn less than men for the same work, which can limit their ability to save money or invest in their business ventures. Similarly, minority communities often have lower average incomes and limited access to financial institutions that can provide loans or other forms of funding.

How they impact financial literacy and self-employment

Gender and race have a significant impact on financial literacy and self-employment. Women, for instance, are less likely to be financially literate than men. Studies show that only 18% of women could answer basic financial questions correctly, compared to 35% of men. This gender gap in financial literacy could be due to several factors, including lack of access to resources such as financial education courses and unequal pay.

Similarly, race also plays a role in determining an individual’s level of financial literacy and self-employment success. Research has shown that African Americans and Hispanics are more likely to have low levels of financial literacy than whites. Moreover, they are less likely to own businesses or work for themselves compared to their white counterparts

Conclusion:

In conclusion, financial literacy is crucial for self-employment success regardless of gender and race. However, research suggests that women and minorities face more significant barriers related to access to resources and social norms. It is essential to recognize these obstacles and work towards creating more equitable opportunities for everyone. Providing financial education tailored to the unique needs of diverse communities can help bridge the gap in financial knowledge and lead to greater entrepreneurial success. We must continue to advocate for policies that promote financial inclusion, support small businesses, and empower underserved communities. Only then can we create a level playing field where everyone has an equal chance of achieving their dreams through self-employment.

Be First to Comment