Finance charges are fees that are applied to an outstanding balance on a credit card, loan, or other forms of credit. Understanding the different types of finance charges and how they affect your finances can help you manage your money more effectively and responsibly. From interest to late fees, there are many forms of finance charges that can be applied to your account depending on the terms you have agreed to in the contract or agreement.

Types of Finance Charges

Finance charges are fees that are charged to customers for borrowing money or for purchasing goods and services on credit. These charges can include interest payments, late payment fees, bounced-check fees, annual membership fees and other related costs associated with financial transactions. Understanding the different types of finance charges is important when it comes to managing your finances responsibly.

Interest payments are one of the most common types of finance charges. Interest is typically charged on loans such as mortgages, car loans, student loans or personal lines of credit. The amount of interest owed is calculated based on the principal balance remaining and the applicable rate set by the lender or creditor.

Another type of finance charge is a late payment fee which applies when a customer fails to make their loan payment before its due date. This fee may be assessed in addition to an increase in interest rates if payments remain delinquent for an extended period of time.

Sources of Finance Charges

Finance charges typically come from a variety of sources. The most common source of finance charge is interest rates that are applied to loans or lines of credit. Loan origination costs, such as processing and application fees may also be included in the cost of borrowing money. Additionally, many credit cards have an annual membership or participation fees which may be considered finance charges as well.

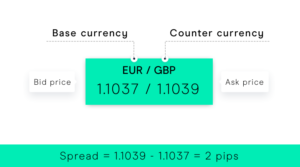

Calculating Interest Rates

Interest rates are an important factor in understanding how much money you may owe on a loan or other finance charge. Calculating interest rates is key to understanding the total cost of any financing agreement and can be used to evaluate different types of financial products.

To calculate the interest rate, you’ll need to know the amount borrowed, the term of repayment, and any fees associated with the loan. Once you have all this information, it’s time to crunch some numbers – start by multiplying the principal amount borrowed by the annual percentage rate (APR).

Divide that result by 12 for monthly interest rates. For example, if you borrow $1,000 at 10% APR for one year, your monthly interest rate would be 0.83%. Then add in any additional fees associated with your loan and divide that number by 12 months to get your total finance charge per month.

Costs Associated with Finance Charges

Finance charges are fees that consumers must pay for the privilege of having access to a loan or credit. Understanding these costs is essential for anyone considering taking out a loan or using their credit cards. Knowing how much you will owe upfront and over time can help you make an informed decision about borrowing money and can save you from being caught off guard by unexpected fees.

Finance charges come in many forms, depending on the type of debt taken out. For example, credit cards usually carry an annual percentage rate (APR) as well as a late payment fee if payments are not made on time.

Home loans may have closing costs such as appraisal and inspection fees, origination points or other miscellaneous fees tacked on top of the principal borrowed amount. Personal loans can also have additional finance charges like origination fees, processing fees and prepayment penalties, if applicable.

Conclusion

Finance charges can be the bane of a consumer’s existence. They are the interest and fees associated with credit, loans, and other financial services that can quickly add up and increase the amount of debt an individual has.

Finance charges can be avoided in some cases, but they are often unavoidable when it comes to financing or credit-related purchases. For anyone considering taking out a loan or using their credit card for a purchase, it is important to understand how finance charges work to help minimize any potential financial burden they may incur.

When it comes to financing charges, knowledge is power. Consumers should educate themselves on what kind of fees and interest rates they could face when using certain types of borrowing services or utilizing their credit cards. This includes understanding how different payment schedules affect interest rates as well as the availability of low-interest options such as balance transfers or promotional offers from lenders.

Be First to Comment