For those looking to make their money work for them, understanding how to calculate Return On Investment (ROI) is essential. ROI is a ratio that helps investors measure how much money they are likely to make from an investment.

Calculating ROI requires knowledge of the costs associated with an investment and the projected returns that it will generate. In this article, we will discuss what ROI is, how to calculate it, and why it’s important when considering investments.

Definition of ROI

ROI, or return on investment, is a financial metric used to measure the efficiency of an investment. It compares the amount of profit generated from an investment to the amount invested and expresses it as a percentage. ROI can be used for any type of asset or project, including stocks, bonds, real estate investments and business initiatives.

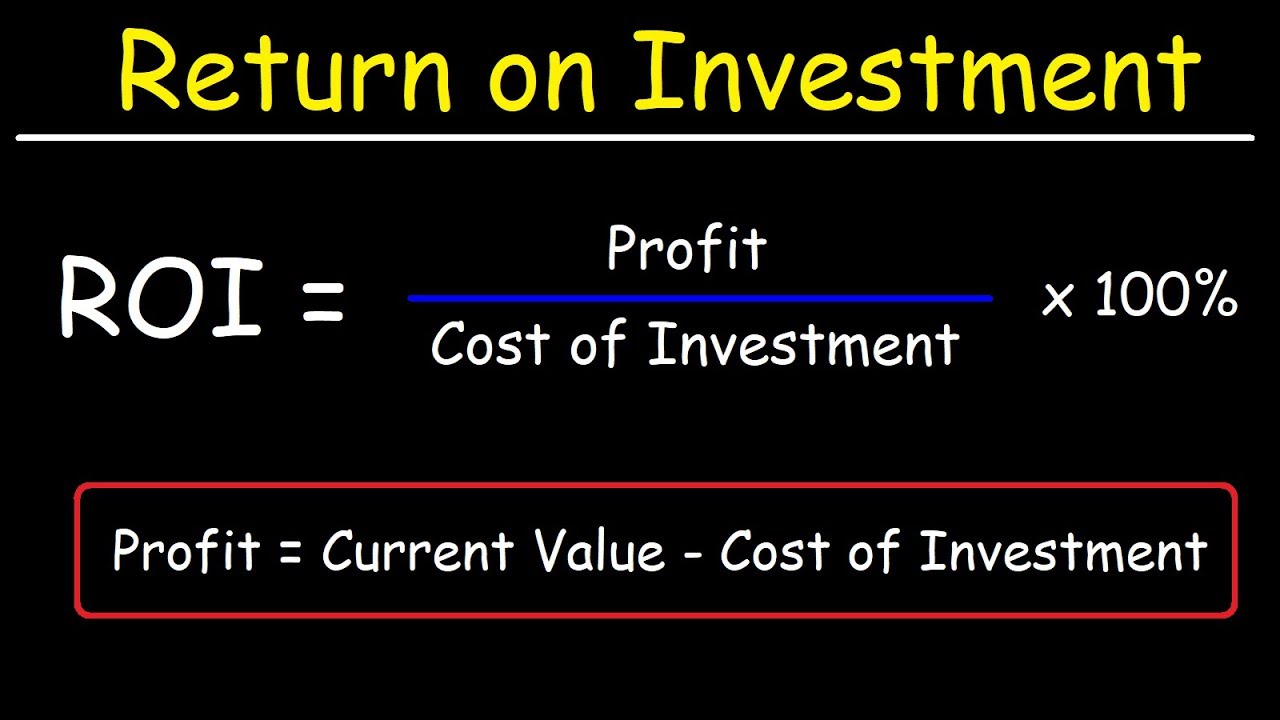

To calculate ROI you subtract the initial cost from the final value of your investment and then divide it by the initial cost. This gives you a ratio that can be expressed as a percentage. For example, if an investor spends $1 million on the stock in a company and when they sell it two years later has earned $2 million their ROI would be 100 percent — double what they initially spent.

Calculating Basic ROI

Calculating return on investments (ROI) is a crucial part of any investment strategy. ROI is the rate of return you can expect to receive from an investment, and it provides investors with an indication of the performance they can expect. Knowing how to calculate ROI is important for any investor, as it will help them analyze their investments and determine if they are achieving their desired returns.

ROI calculations are simple and straightforward. The formula used to calculate ROI is: [(Gain From Investment – Cost Of Investment)/Cost Of Investment] x 100 = Return On Investment. Let’s consider an example where an investor purchases a stock for $100 and then sells it after one year at $200. In this case, the gain would be $100 ($200 minus $100).

Factors Affecting ROI

When considering investing in any product or service, it is important to understand the return on investment (ROI) that can be expected. Calculating ROI involves understanding a variety of factors including the cost of the investment, expected returns, and potential risks associated with it. Before making any decisions regarding investments, it is important to take time to understand what factors will affect an individual’s ROI.

The most significant factor affecting an individual’s return on investment is their initial capital outlay. This includes any upfront costs associated with purchasing a product or service as well as ongoing expenses involved in managing and maintaining the asset.

Additionally, individuals should consider future predicted returns from their investments and how long those returns may take before coming into fruition. Other variables such as interest rates, inflation rates, market conditions and political policies should also be taken into account when calculating ROI.

Benefits of Knowing ROI

Return on investment (ROI) is one of the most important metrics when it comes to measuring success in business. Knowing how much you’re investing, and what your expected return should be, can help you make smart decisions about where you focus your efforts. Being able to calculate ROI provides valuable insight into the performance of investments and can play an essential role in improving operational efficiency.

Having a clear understanding of ROI helps ensure that businesses are making sound financial decisions by being able to measure the performance of investments against their expected returns. It also enables companies to identify which strategies are more successful than others and to allocate resources accordingly.

Additionally, it gives businesses a better sense of how they’re faring compared to competitors by helping them track their own progress over time. This can be particularly valuable for startups who need to keep up with larger companies in terms of growth and profitability.

Conclusion

In concluding the article on calculating return on investments, it is important to understand how to maximize profits. From budgeting, determining break-even points, and analyzing market trends, many investments carry a variety of risks. To ensure success with your investment decisions, consider the following strategies:

First and foremost, be aware of all potential risks associated with an investment before deciding to move forward. By weighing these risks against expected returns you can make informed decisions that will help mitigate losses in the long run. Next, identify any factors that may affect expected returns such as inflation or changing economic conditions. Finally, create a plan for monitoring progress and adjusting your strategy accordingly as time goes on.

By taking these steps you can have confidence in your investment decisions while also maximizing profits over time.

Be First to Comment