What Are A Securities

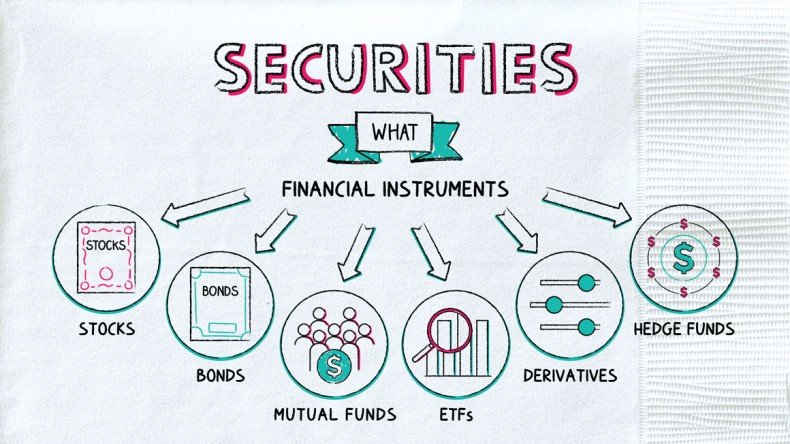

Securities are a type of investment instrument that often provide an investor with the potential to receive income or capital gains. They can take many forms, such as stocks, bonds, derivatives, and other types of investments.

Understanding what securities are and how they work is essential for any investor who wants to make informed decisions about their portfolio. This article will explain in detail what securities are, how they work, and the different types of securities available for investors.

Legally Defined

Security is a legal term that refers to a broad range of financial instruments, typically stocks and bonds, which are traded through financial exchanges. Securities can be issued by corporations, governments and other entities in order to raise capital for their operations. This article will discuss the legally defined definition of what constitutes security.

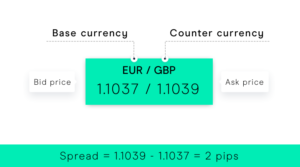

Securities are defined within the context of securities legislation as any form of investment such as shares, stocks, bonds or derivatives that have the purpose or effect of changing ownership from one person to another. These instruments are generally bought and sold on public markets, such as stock exchanges, but may also be traded over-the-counter (OTC) between two parties without going through an exchange.

Types of Securities

Securities are investments that represent ownership in a company or other form of asset. They are an important part of any investor’s portfolio and can help create a diverse range of income for the individual. Two of the most popular types of securities are stocks, bonds, and mutual funds.

Stocks are one type of security that gives investors partial ownership in a company or corporation. Typically, these shares can be traded on public exchanges such as the New York Stock Exchange or Nasdaq. When investing in stocks, you may receive dividend payments if the company is profitable and share prices increase over time.

Bonds are another type of security that represents a debt owed to an investor by a government entity or corporation. Bonds often offer higher yields than stocks but they also carry more risk as they depend on the issuer’s ability to repay its debt obligations.

How to Invest in Securities

Investing in securities is a popular way to diversify and grow your financial portfolio. Securities are investments that represent an ownership stake in a company or other entity, such as government bonds or mutual funds.

Investing in securities can yield higher returns than traditional savings accounts, but it also carries greater risk. It is important to understand the risks associated with investing in securities before getting started. Here is an overview of how to invest in securities and what you need to know before making any investment decisions.

Securities can be bought directly from the issuing companies themselves, or through brokers on stock exchanges like the New York Stock Exchange (NYSE). You will need a brokerage account with an online broker to buy stocks and bonds traded on these exchanges. When choosing stocks, pay attention to factors like past performance, management strategies, industry trends, and potential risks.

Benefits of investing in Securities

Investing in securities can be a great way to diversify your portfolio and potentially generate returns. Securities are investments that represent ownership or rights to ownership of an underlying asset or group of assets, such as stocks and bonds. Investors can benefit from investing in securities in a variety of ways, including the potential for growth, income generation, and financial stability.

For investors who are looking for potential long-term growth opportunities, investing in stocks may be beneficial. Stocks represent partial ownership of a company, which means you have the potential to earn more when the company’s stock price increases.

Bonds are also commonly used by investors who want more stability and predictability while still earning some return on their investment over time. The debt obligations associated with bonds tend to provide added security since they are often backed by government entities or large corporations that offer regular coupon payments until maturity.

Conclusion

The conclusion of this article on the securities market is that it is an integral part of the global economy. It is a large, complex marketplace that requires detailed knowledge and experience to navigate successfully. For those who understand how to take advantage of the available opportunities, there can be immense rewards.

Securities, whether stocks, bonds or investments in mutual funds, offer investors a wide range of potential rewards. Investing strategically and understanding how markets work helps investors maximize returns while minimizing risk.

Researching different options and investing with caution are key factors to success in the securities market. Taking risks can pay off but it’s important to remember that losses are just as likely as gains in this type of investment endeavor.

Be First to Comment